Uncovering JAPA

Affordable Housing Without Public Subsidies

The housing affordability crisis is a prevalent issue for low- and moderate-income renters in the United States.

While government subsidies can be highly effective, funding limitations have prevented most renters who are eligible for subsidies from receiving them. Many of these low-income renters live in small rental properties (SRPs), which consist of unsubsidized and unregulated low-cost rental units — many by choice, others by necessity.

Landlords Set Below-Market Rents Strategically

Although such low rents might be attributed to low-quality construction and undesirable locations, scholars have long argued that the landlords purposely set the rents below market for decent-quality units. However, this argument has never been empirically proven and the extent to which owners set rent below the market is unclear.

To investigate the extent of below-market rent setting and the factors that affected the SRP owners' decision to lower the rent below its market value, Nathaniel Decker surveyed 950 SRP owners in the top 149 U.S. metros.

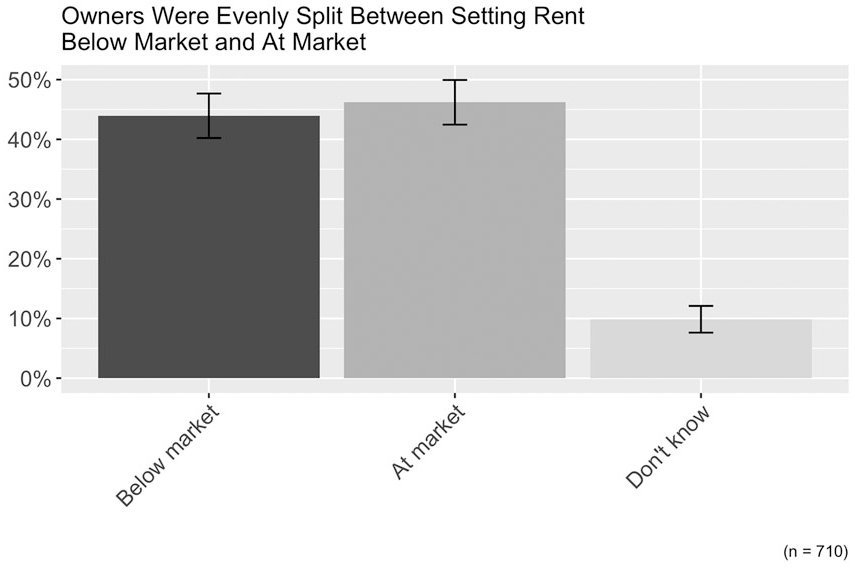

In "Affordable Housing Without Public Subsidies" in the Journal of the American Planning Association (Vol. 87, No. 1), Nathaniel Decker argues that almost half of the survey respondents intentionally provided an average of 16 percent discount to their tenants for diverse reasons, which involved economic and social factors, as well as owners' market expertise.

Based on an additional 161 phone interviews with SRP owners, Decker found that landlords used below-market rent strategies to prevent vacancy losses and to attract or retain trusted tenants. In some cases, they considered the tenants' income in setting up the rents.

These interviews also suggested that larger portfolio landlords were less likely to set rents below market due to escalator clauses in the leases and utilization of market data. However, the impact of portfolio size was not proven to be substantial in the regressions despite the results of these interviews.

Figure 1: Proportion of survey respondents who reported setting rent below market.

Understanding Factors in Below-Market Rents

Regression analysis added a critical layer to understanding factors affecting rent setting among the group of all SRP owners in the United States. Interestingly, the factors that are assumed in the existing theory to affect the rent prices (i.e., local market conditions, landlords' asset portfolio, and experience) had no discernible impact on below-market rent setting.

However, some factors appeared to influence the landlords' pricing decisions such as tenants' duration of residence, the perception of tenants' ability to pay, the intention to limit turnover, and the use of technological tools in managing their properties.

Soon, below-market small rental properties may present an opportunity for municipalities to tackle the shortage of affordable rental units.

Therefore, planners and policymakers should start considering a range of policies to generate and preserve the stock of below-market SRP units. Additionally, as SRPs are far less regulated, they should also aim to address equity concerns by ensuring that improvements in affordability are fairly distributed according to the tenants' economic ability.

Although establishing a small rental property policy can be quite challenging due to the lack of existing data about rent setting, this topic is worth exploring as innovations and reform in housing policies are necessary to address the continuum of housing needs. Developing policies that can produce systemic change in housing outcomes can be extremely powerful as subsidies are limited.

Top image: Getty Images illustration.